The Importance Of Budgeting In Business & How To Do It

A budget is a comprehensive financial plan for achieving the financial and operational goals of a company. When used correctly, a budget is the map of the company’s strategic plan. In creating the budget, the company is developing its objectives for the acquisition and use of its resources. Once in place, it becomes a valuable benchmark to determine how well the steps taken by management are ensuring objectives are attained.

A budget is a plan to:

- Control the finances of the business

- Ensure that the business are able to fund its current commitments

- Enable the company to meet its objectives and make confident financial

- Make sure that the business has money for future projects.

The benefits of budgeting:

- Budgeting can help a business to estimates revenue, plans expenditure and restricts any spending that is not part of the plan

- Budgeting ensures that money is allocated to those things that support the strategic objectives of the business

- A well communicated budget helps everyone understand the priorities of the business

- Formalizes the coordination of activities between departments while aligning these activities to the company’s strategic plan and that they are working

- towards the same goal

- Provides the assignment of decision-making responsibilities and enhances management’s responsibility

- The process of creating a budget provides opportunities to involve staff, resulting in them sharing the organisation’s vision

- Engaging the team in reviewing and comparing the budget with actual facts can provide information that highlights the strengths and weaknesses of business.

- Improves performance evaluations – providing a common base for discussion on how well the manager met his goals

- Providing a talking point concerning why actual results veered from the original budget

A good budget shall include the following 7 components of;

Keeping record of the numbers is essential to keep track of where the money had gone to, and what amount had flown into the account that is available for use. A record of last year’s numbers or industry averages (for startups) can help a company roughly grasp the estimated financial in and out for the current year.

If you’re running your business without a proper budget you may be actually just running around in circles and not meeting your long-term goals. By taking the time now to set a budget, you will free up time in the future and give yourself the best chance of achieving the rewards you want for your hard work.

Share Via

You May Also Like

February 6, 2024

QR Code Label

February 6, 2024

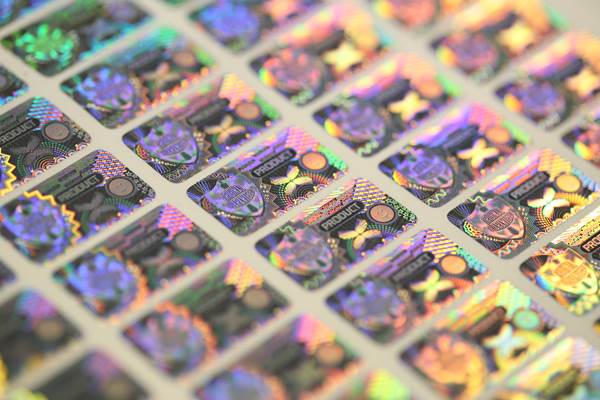

Holographics Products

February 6, 2024